Update

With new updates to dYdX on the horizon, we’re working hard to make sure that traders have a clearer understanding of protocol fees. Previously, holders of $DYDX or $stkDYDX were eligible to receive a trading fee discount based on the size of their current holdings. We will be winding down fee discounts and reverting back to normal fees for all dYdX traders on September 29th at 1pm ET. Hedgie holders will be eligible to receive a 3% fee discount beginning September 29th and holding multiple Hedgies will not increase the discount percent.

How Fees work

dYdX uses a maker-taker fee model for determining its trade fees. There are two types of orders on dYdX — Maker and Taker orders.

Maker orders are orders that do not immediately fill and rest on the order book — these orders add depth and liquidity to the order book.

Taker orders, on the other hand, immediately cross existing Maker orders. They remove liquidity from the order book.

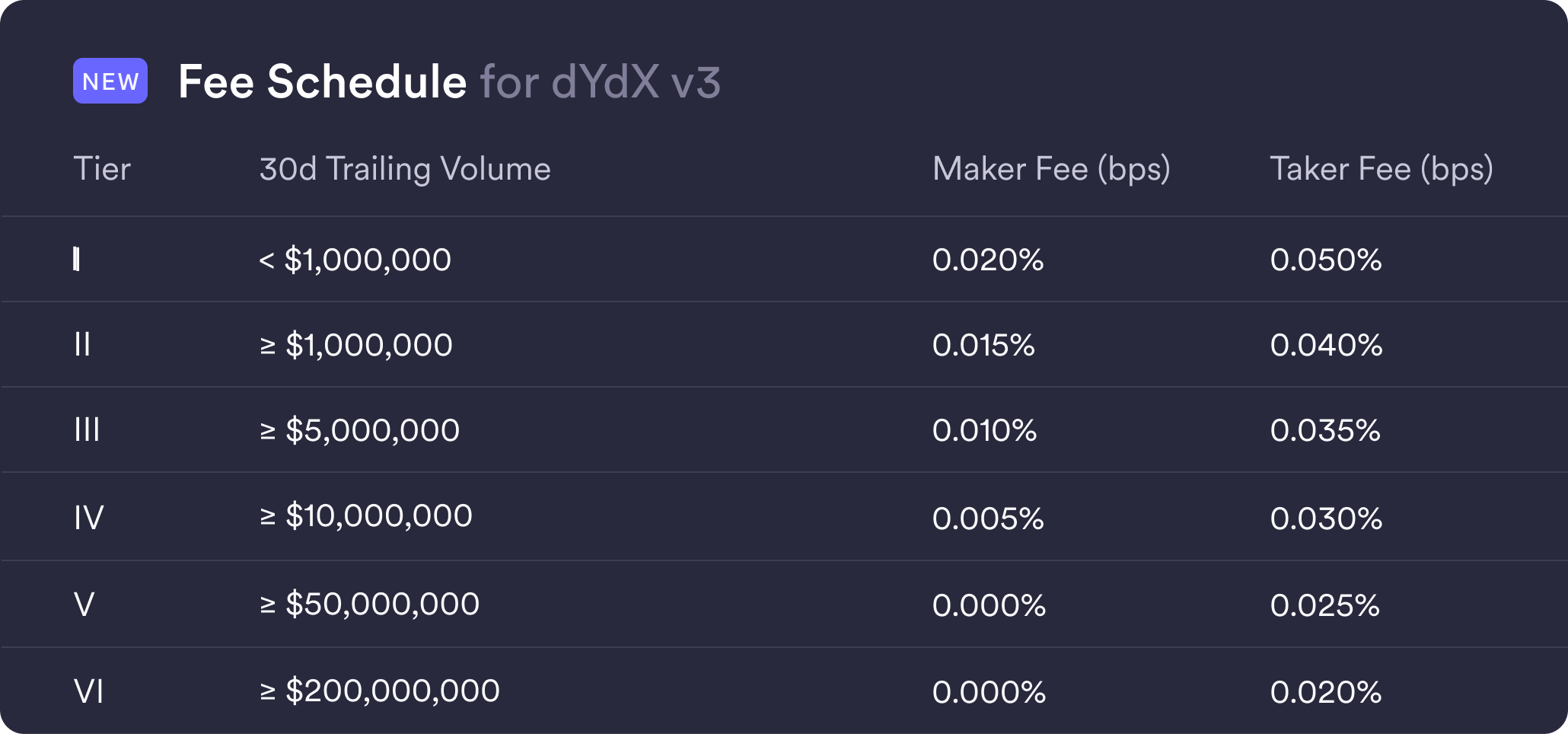

The fee structure for all dYdX traders, regardless of token holdings will be as follows:

To learn more about maker and taker orders and the fee structure, check out our help center article.

About dYdX and Terms

dYdX is the developer of a leading decentralized exchange on a mission to build open, secure, and powerful financial products. dYdX currently runs on audited smart contracts on Ethereum, which eliminates the need to trust a central exchange while trading. We combine the security and transparency of a decentralized exchange, with the speed and usability of a centralized exchange.

Terms and Conditions. This post is subject to the dYdX Terms of Use. dYdX products and services are not available to persons or entities who reside in, are located in, are incorporated in, or have registered offices in the United States or Canada, or Restricted Persons (as defined in the dYdX Terms of Use).