Our new Layer 2 cross-margined Perpetuals are now live in production, for all traders permitted under our Terms of Use. To significantly scale trading, dYdX and StarkWare have built a Layer 2 protocol for cross-margined Perpetuals, based on StarkWare’ StarkEx scalability engine ("Layer 2") and dYdX’s Perpetual smart contracts. Traders can now trade with zero gas costs, lower trading fees, and reduced minimum trade sizes

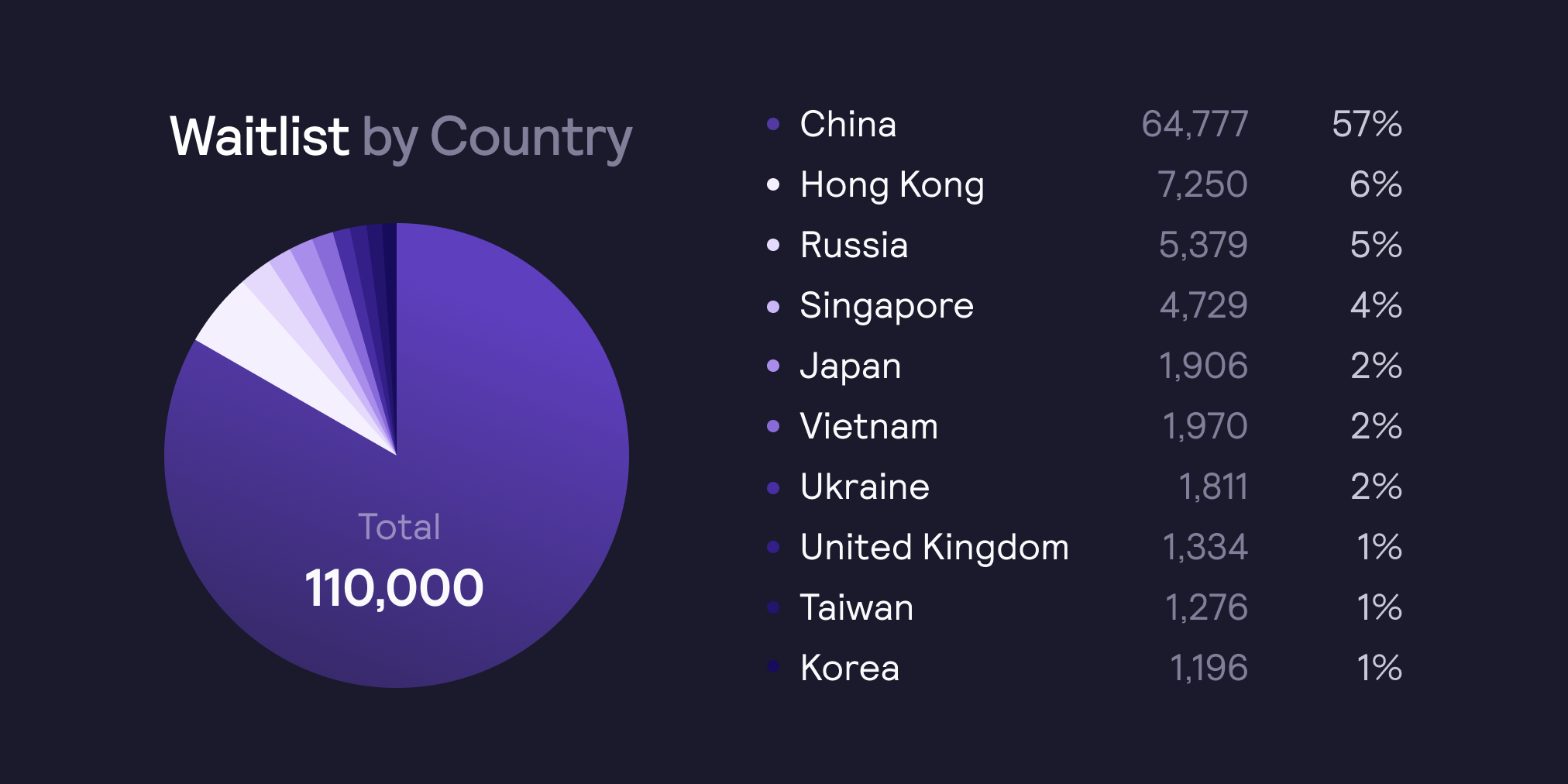

In February, we launched a closed Alpha on mainnet for users, liquidity providers, and strategic partners. In the last few weeks, we have thoroughly tested the stability of the system, incorporated user feedback, and launched many new features. We had 110,000 users sign up for the waitlist, and users traded $90,000,000 in volume across over 25,000 trades. Today, we are excited to announce the public launch of our new protocol.

We are thrilled by the enthusiasm of new users interested in trading decentralized Perpetuals. Crypto is global and our international user base is quickly growing. Following our Series B financing, we announced our goal of strategically investing in international growth markets, such as Asia, with a focus on Greater China. Asian users represented ~78% of our waitlist. We saw the most sign-ups from China, followed by Hong Kong, Russia, Singapore, Japan, Vietnam, Ukraine, United Kingdom, Taiwan, Korea, and India.

With the transition to our Layer 2 protocol, we’ve built an entirely new product and trading system for cross-margined Perpetuals from the ground up. The product features a new and improved UI, truly instant trading, and all the advanced features traders expect while trading Perpetuals. During our alpha, we built additional features including:

🌈 More Trading Pairs

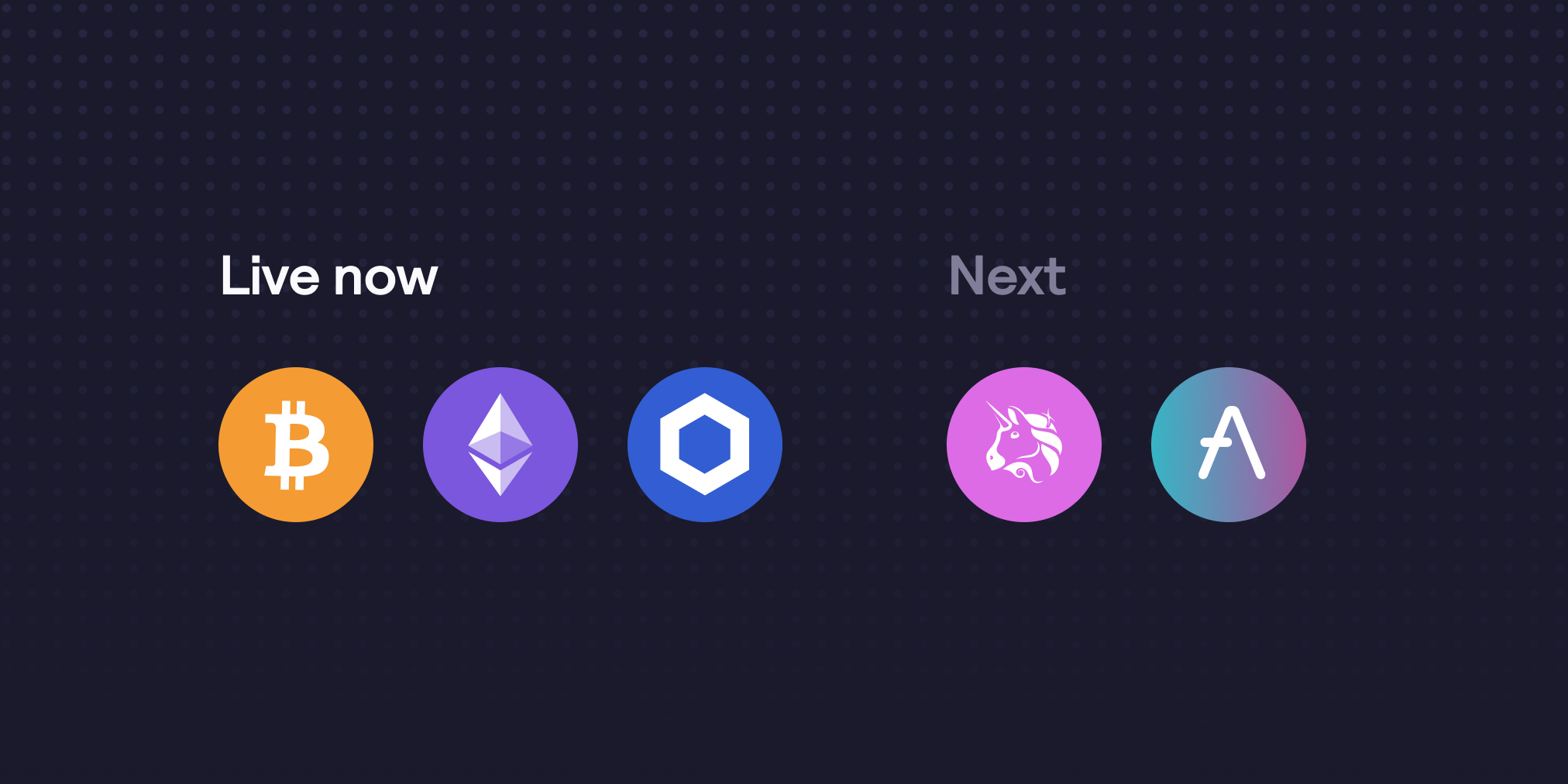

With cross margining and increased scalability, we can launch many more markets on dYdX. During the alpha, we supported Perpetuals for BTC-USD, ETH-USD, and LINK-USD. We plan to support AAVE-USD and UNI-USD in the near future, with many more pairs very soon. We are focused on listing DeFi tokens, as well as the most traded cryptocurrency pairs by volume. For a full list of supported Perpetual markets, please visit here.

🚀 Fast Withdrawals

Fast withdrawals allow for users to receive funds immediately without waiting for a Layer 2 block to be mined on Ethereum. Users must pay a fee for fast withdrawals equal to the greater of the gas fee incurred and 0.1% of the withdrawal amount. Fast withdrawals also are subject to a maximum size of $25,000.

⚡️ 0x API Integration

All of our Perpetuals are settled and margined in $USDC . However, users will soon be able to deposit or withdraw other assets into their Perpetual account through dYdX’s integration with 0x API. Learn more here.

Press Coverage

You can read more about our Layer 2 coverage on CoinDesk, The Block, ChainNews, ODaily, or Forklog. You can also read or listen to recent events with Laura Shin's Unchained Podcast, StarkWare, The DeFiant, CoinDesk TV, KryptoSeoul, Korea Economic Daily, and Software Engineering Daily.

Start trading

You can start trading Perpetuals on Layer 2 here. Developers can also begin reading our latest API documentation here, and our audited smart contracts here.

This product is not available to traders in the United States or Restricted Territories, as defined in the Terms of Use. By using this product, you also agree to our Privacy Policy.

What about Perpetuals on Layer 1?

Our Layer 1 Perpetuals will be wound down on April 20, 2021. Users will need to close their positions on our Layer 1 protocol and then open new positions on our Layer 2 protocol.

What is Layer 2?

StarkWare zkSTARKS technology is a form of ZK-Rollup technology that significantly increases dYdX’s trade settlement capacity, while still basing its security on the underlying Ethereum blockchain. StarkWare’s dYdX integration combines STARK proofs for data integrity with on-chain data availability to ensure a fully non-custodial protocol. Trades are settled on a Layer 2 system, which publishes Zero-Knowledge Proofs periodically to an Ethereum smart contract in order to prove that state transitions within StarkWare's Layer 2 are valid.

Why is dYdX moving to Layer 2?

Ethereum can process around 15 transactions per second (TPS), which is not enough to support the hypergrowth of DeFi. Over the past few months, our traders have experienced extremely high fees due to gas costs on Ethereum. With a Layer 2 network, dYdX trading fees will now be in line with what traders are used to from centralized exchanges.

It’s not all just about fees either. With StarkWare’s Layer 2 network, dYdX now offers significant improvements to the trading experience over anything else that’s been seen in DeFi so far.

What does Layer 2 mean for traders?

Significantly Lower Fees

Due to the significant improvement in scalability that Layer 2 offers, we can pass on the savings to traders in the form of reduced trading fees across the board. Most importantly, users no longer have to pay gas fees while trading!

We will be releasing a new volume-weighted maker-taker fee schedule that is competitive with fees on centralized exchanges. Our latest Perpetuals fee schedule for Layer 2 can be found here.

Reduced Minimum Trade Sizes

Because it’s now much cheaper to execute trades, we have decreased minimum trade sizes, allowing traders to trade on dYdX with less capital. Our minimum trade sizes can be found here.

Cross-Margin

Traders can trade on multiple Perpetual markets using a single margin account, allowing for dramatically increased capital efficiency while trading multiple pairs, and a much simpler trading experience. Traders will be able to convert via the 0x API most ERC-20 assets to $USDC collateral, and then trade all of the markets dYdX offers in that same account. More details on cross-margining can be found here.

Instant Trade Settlement

With StarkWare’s Layer 2 network and dYdX’s off-chain matching engine, trades are executed instantly. Trading on dYdX now feels every bit as fast as trading on a centralized exchange.

Faster Price Oracles

Oracles verify prices using STARK-compatible signatures, allowing smart contracts to use prices as soon as they are signed, rather than waiting for a transaction to be mined. This significantly reduces the latency of oracle price updates from minutes on Ethereum to fractions of a second on StarkWare’s Layer 2 networks.

We’re currently using Chainlink’s oracle network to power secure price feeds for our Layer 2 protocol. Chainlink has integrated with Starkware to extend the Chainlink Network’s oracle functions to high-performance Layer 2 solutions. In a short time, other oracle providers, such as MakerDAO, may be used for some markets.

Higher Leverage & Lower Liquidation Penalties

Because of the performance improvement in price oracles, liquidations now occur much faster and more safely. This means we can now offer both higher maximum leverage as well as lower penalties when liquidated. Users can now trade with higher leverage – up to 25× – on dYdX on certain Perpetuals markets. More details on maximum leverage can be found here.

Greater Privacy

With ZK-Rollups, not all transaction details are published on-chain, but rather just the balance changes. Therefore, privacy is greatly enhanced as traders do not need to worry about proprietary trading strategies being replicated or trading activity being monitored.

About dYdX

dYdX is the developer of a leading decentralized exchange on a mission to build open, secure, and powerful financial products. dYdX runs on audited smart contracts on Ethereum, which eliminates the need to trust a central exchange while trading. We combine the security and transparency of a decentralized exchange, with the speed and usability of a centralized exchange.

About StarkWare

StarkWare develops software to improve blockchain scalability by allowing any type of computation to move off-chain, using the Ethereum blockchain as a public immutable commitment layer. Focusing on scalability, StarkWare has the fastest in-class technology for asserting computational integrity via succinct, transparent, & post-quantum-secure proofs