You can easily propose new market listings on dYdX Chain! We maintain an open sourced list of markets and parameters likely to be compatible with optimal technical performance of the dYdX v4 software (the “dYdX Chain”).

How Do I Propose A New Market?

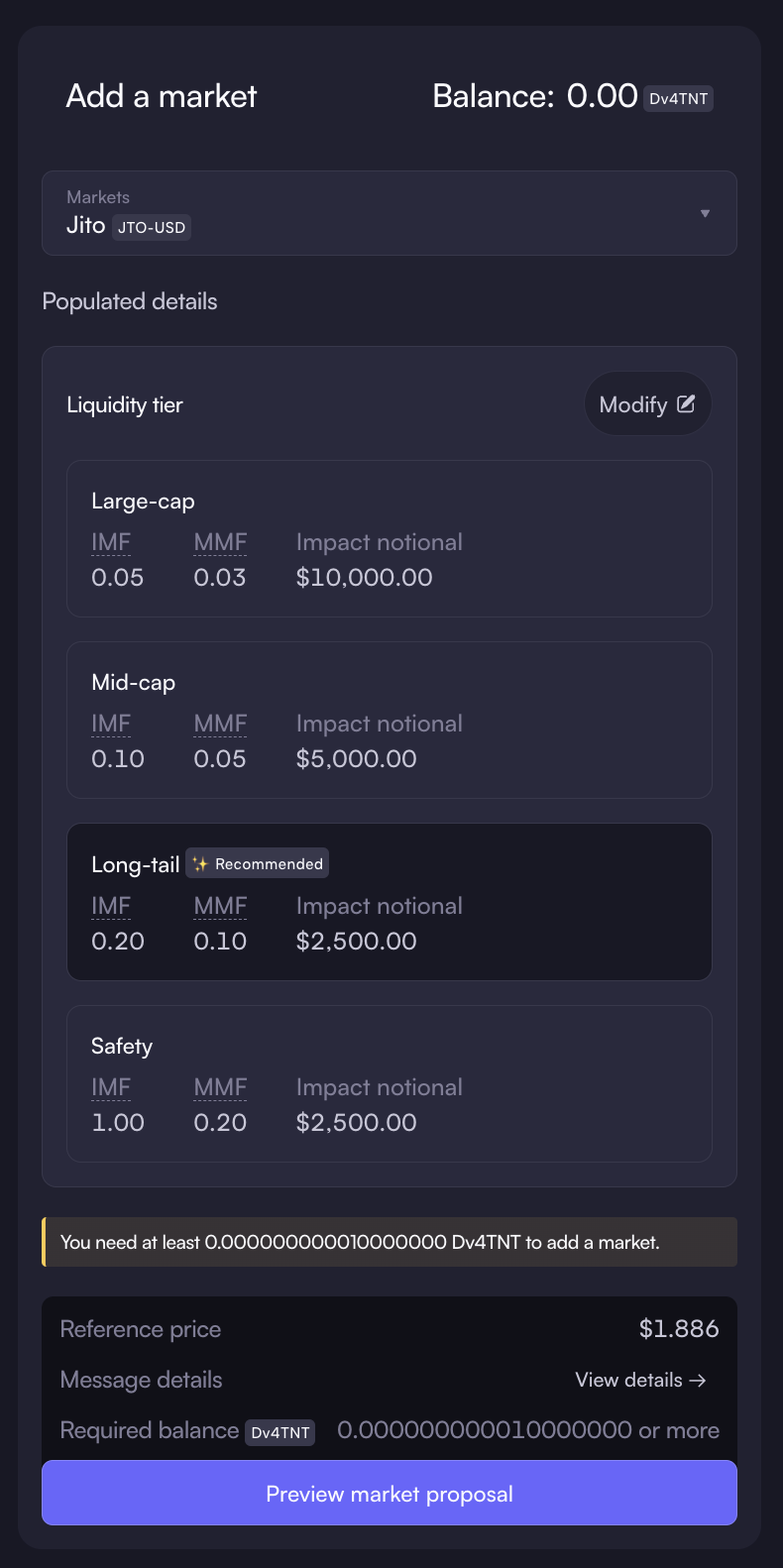

After navigating to the markets tab on dYdX Chain’s interface, you may click on the “Add New Markets” button. Thereafter you will be prompted as follows:

Select a market: Search or choose from a list of markets you’d like to add. dYdX Trading maintains an open sourced list of market parameters. For more information on methodologies and how the compatibility of markets with the software is determined, head here.

Confirm details: Once a market is selected, the Reference Price, Oracles, and Liquidity Tier will be populated.

Propose new market: Sign a transaction that creates a proposal to add the new asset to dYdX Chain!

And it’s that simple! You can find more details and documentation on certain market parameters, inputs, oracles, and much more here. Please also note that a balance of the applicable governance tokens is required to initiate the market listing proposal.

See below for a sample of what it may look like to add a new market.

FAQs

What happens to the applicable governance tokens after sending a proposal?

Governance tokens will become locked once the market proposal is sent for a governance vote. Tokens will then be returned to your wallet after the vote is completed! In the event of slashing (governance results in a vote of “no with veto”), tokens would not be returned.

Can I adjust any market parameters other than the liquidity tier?

At the moment, the liquidity tier is the only market parameter that can be adjusted through this widget. However, by following the procedure documented here, parameters can be customized. We suggest reading through these guidelines for proposing a new market for those interested in submitting a more customized market listing.

How are liquidity tiers chosen?

The liquidity tiers have been defined according to the following conditions (please note that these can be updated through governance in the future):

Large Cap: BTC/ETH

Mid-Cap: Markets with at least 8 robust oracle sources with liquidity >= 50K on both sides and 30d daily spot trading volume >= $100M

Long-tail: All others

How are markets determined to be compatible?

dYdX Trading maintains an open sourced list of market parameters. After assessing public data regarding market depth, volume, and number of oracles for exchange listings, a compatibility rating is then assigned to assets likely to be compatible with optimal technical performance of dYdX Chain. For more information on methodologies and how markets are assessed for software compatibility, head here.

Do I need to use this feature to propose a new market?

While this widget is a way of proposing a new market, it is not the only way to do so. By following the procedure documented here, a more customized market listing can be proposed. We suggest reading through these guidelines for proposing a new market for those interested in submitting a more customized market listing.

What markets should be added?

Users of the dYdX Chain software decide what markets should be added. Users are encouraged to consider the information about likely software compatibility provided here. Users are also encouraged to weigh other factors that may be relevant to listing decisions, such as the trading volume, liquidity, and market cap of the relevant crypto-asset or related derivatives; its development history and track record; technical robustness and security, susceptibility to fraud, manipulation, rug pulls or other inappropriate practices, and compliance with the laws of relevant jurisdictions.

About dYdX and Terms

dYdX’s mission is to democratize access to financial opportunity. We believe that the dYdX Chain represents a large step forward in service of that mission and enabling market listings driven by the community furthers this goal.

If building the future of DeFi is something you’re interested in, check out what it’s like to work at dYdX and our open roles!

Join the discussion on Discord, participate in the dYdX community, or follow us on Twitter.

Learn more at dydx.exchange.

Terms and Conditions: This document provides information with respect to the default settings of dYdX Trading Inc. (”dYdX”) open source v4 software (”dYdX Chain”). dYdX does not deploy or run v4 software for public use, or operate or control any dYdX Chain infrastructure. dYdX is not responsible for any actions taken by other third parties who use or deploy v4 software, including dYdX Chain. dYdX services and products are not available to persons or entities who reside in, are located in, are incorporated in, or have registered offices in the United States or Canada, or Restricted Persons (as defined in the dYdX Terms of Use). The content provided herein does not constitute, and should not be considered, or relied upon as, financial advice, legal advice, tax advice, investment advice or advice of any other nature, and you agree that you are responsible to conduct independent research, perform due diligence and engage a professional advisor prior to taking any financial, tax, legal or investment action related to the foregoing content. The information contained herein, and any use of v4 software, are subject to the v4 Terms of Use.